Is Kentucky Tax Exempt . Kentucky exempts certain prescription drugs from sales and use tax. kentucky tax exemptions. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. Many states have special sales tax rates that apply to the purchase of. what is exempt from sales taxes in kentucky? some customers are exempt from paying sales tax under kentucky law. While the kentucky sales tax of 6% applies to most. what purchases are exempt from the kentucky sales tax? Examples include government agencies, some. kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price.

from www.exemptform.com

some customers are exempt from paying sales tax under kentucky law. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. what is exempt from sales taxes in kentucky? While the kentucky sales tax of 6% applies to most. what purchases are exempt from the kentucky sales tax? Many states have special sales tax rates that apply to the purchase of. kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. kentucky tax exemptions. Kentucky exempts certain prescription drugs from sales and use tax. Examples include government agencies, some.

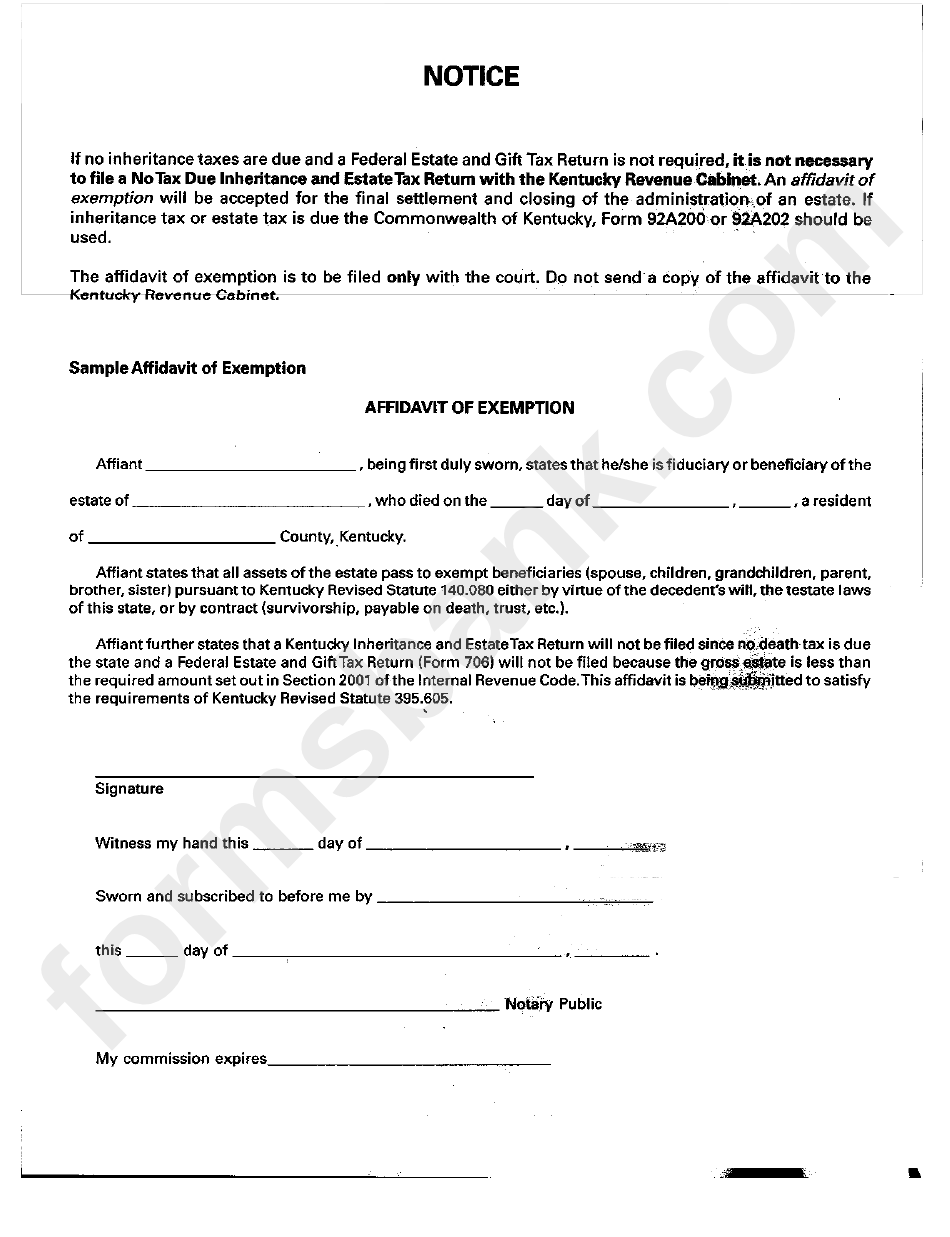

Affidavit Of Exemption Kentucky Tax Exemption Printable Pdf Download

Is Kentucky Tax Exempt kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. kentucky tax exemptions. Examples include government agencies, some. Many states have special sales tax rates that apply to the purchase of. kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. what is exempt from sales taxes in kentucky? Kentucky exempts certain prescription drugs from sales and use tax. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. what purchases are exempt from the kentucky sales tax? some customers are exempt from paying sales tax under kentucky law. While the kentucky sales tax of 6% applies to most.

From www.jacksonenergy.com

Primary Residence Sales Tax Exemption Jackson Energy Cooperative Is Kentucky Tax Exempt Kentucky exempts certain prescription drugs from sales and use tax. what purchases are exempt from the kentucky sales tax? While the kentucky sales tax of 6% applies to most. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. kentucky tax exemptions. Many states have special sales tax rates that apply. Is Kentucky Tax Exempt.

From www.dochub.com

Ky tax exempt form pdf Fill out & sign online DocHub Is Kentucky Tax Exempt some customers are exempt from paying sales tax under kentucky law. kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Many states have special sales tax rates that apply to the purchase of. While the kentucky sales tax of 6% applies to most. Examples include government agencies, some.. Is Kentucky Tax Exempt.

From pafpi.org

Certificate of TAX Exemption PAFPI Is Kentucky Tax Exempt kentucky tax exemptions. what purchases are exempt from the kentucky sales tax? some customers are exempt from paying sales tax under kentucky law. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. what is exempt from sales taxes in kentucky? Examples include government agencies, some. While the kentucky. Is Kentucky Tax Exempt.

From www.withholdingform.com

Ky State Tax Withholding Form Is Kentucky Tax Exempt what is exempt from sales taxes in kentucky? (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. kentucky tax exemptions. Kentucky exempts certain prescription drugs from sales and use tax. what purchases are exempt from the kentucky sales tax? kentucky sales and use tax is imposed at the. Is Kentucky Tax Exempt.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Is Kentucky Tax Exempt what is exempt from sales taxes in kentucky? While the kentucky sales tax of 6% applies to most. what purchases are exempt from the kentucky sales tax? kentucky tax exemptions. Kentucky exempts certain prescription drugs from sales and use tax. kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts. Is Kentucky Tax Exempt.

From hxefvufbe.blob.core.windows.net

How To Get A Tax Exempt Number In Kentucky at Richard Curl blog Is Kentucky Tax Exempt kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. kentucky tax exemptions. While the kentucky sales tax of 6% applies to most. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. what is exempt from sales taxes in kentucky?. Is Kentucky Tax Exempt.

From www.signnow.com

Kentucky Exemption Sales Tax PDF 20172024 Form Fill Out and Sign Is Kentucky Tax Exempt what purchases are exempt from the kentucky sales tax? kentucky tax exemptions. Kentucky exempts certain prescription drugs from sales and use tax. what is exempt from sales taxes in kentucky? kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Many states have special sales tax rates. Is Kentucky Tax Exempt.

From www.exemptform.com

Kentucky Sales Tax Farm Exemption Form Fill Online Printable Is Kentucky Tax Exempt some customers are exempt from paying sales tax under kentucky law. what is exempt from sales taxes in kentucky? kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Many states have special sales tax rates that apply to the purchase of. While the kentucky sales tax of. Is Kentucky Tax Exempt.

From www.formsbank.com

Kentucky Sales And Use Tax Energy Exemption Annual Return Form Is Kentucky Tax Exempt Kentucky exempts certain prescription drugs from sales and use tax. some customers are exempt from paying sales tax under kentucky law. what purchases are exempt from the kentucky sales tax? kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. Examples include government agencies, some. Many states have. Is Kentucky Tax Exempt.

From www.sanpatricioelectric.org

Tax Exempt Forms San Patricio Electric Cooperative Is Kentucky Tax Exempt Examples include government agencies, some. While the kentucky sales tax of 6% applies to most. what purchases are exempt from the kentucky sales tax? (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. kentucky tax exemptions. some customers are exempt from paying sales tax under kentucky law. Many states. Is Kentucky Tax Exempt.

From revneus.netlify.app

Ky Revenue Form 51a126 Is Kentucky Tax Exempt (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. what purchases are exempt from the kentucky sales tax? what is exempt from sales taxes in kentucky? Examples include government agencies, some. kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase. Is Kentucky Tax Exempt.

From www.dochub.com

Ky tax exempt form pdf Fill out & sign online DocHub Is Kentucky Tax Exempt kentucky tax exemptions. Many states have special sales tax rates that apply to the purchase of. what purchases are exempt from the kentucky sales tax? some customers are exempt from paying sales tax under kentucky law. While the kentucky sales tax of 6% applies to most. kentucky sales and use tax is imposed at the rate. Is Kentucky Tax Exempt.

From www.exemptform.com

Kentucky Sales Tax Exemption Form Is Kentucky Tax Exempt what purchases are exempt from the kentucky sales tax? Kentucky exempts certain prescription drugs from sales and use tax. what is exempt from sales taxes in kentucky? some customers are exempt from paying sales tax under kentucky law. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. kentucky. Is Kentucky Tax Exempt.

From exorzugcv.blob.core.windows.net

How Does Business Tax Exempt Work at Rosie Baggs blog Is Kentucky Tax Exempt kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. some customers are exempt from paying sales tax under kentucky law. what purchases are exempt from the kentucky sales tax? Many states have special sales tax rates that apply to the purchase of. Examples include government agencies, some.. Is Kentucky Tax Exempt.

From www.dochub.com

Ky tax exempt form pdf Fill out & sign online DocHub Is Kentucky Tax Exempt kentucky tax exemptions. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. Many states have special sales tax rates that apply to the purchase of. Examples include government agencies, some. While the kentucky sales tax of 6% applies to most. some customers are exempt from paying sales tax under kentucky. Is Kentucky Tax Exempt.

From www.youtube.com

Kentucky State Taxes Explained Your Comprehensive Guide YouTube Is Kentucky Tax Exempt kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. what purchases are exempt from the kentucky sales tax? Examples include government agencies, some. kentucky tax exemptions. Many states have special sales tax rates that apply to the purchase of. what is exempt from sales taxes in. Is Kentucky Tax Exempt.

From www.formsbank.com

Affidavit Of Exemption Form Kentucky Revenue Kentucky Is Kentucky Tax Exempt (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. what is exempt from sales taxes in kentucky? Kentucky exempts certain prescription drugs from sales and use tax. some customers are exempt from paying sales tax under kentucky law. what purchases are exempt from the kentucky sales tax? Many states. Is Kentucky Tax Exempt.

From estabneilla.pages.dev

Kentucky Farm Tax Exempt Form 2025 Lola Lillian Is Kentucky Tax Exempt While the kentucky sales tax of 6% applies to most. kentucky sales and use tax is imposed at the rate of 6 percent of gross receipts or purchase price. (july 15, 2019)— due to recent legislative changes, the department of revenue (dor) has updated the resale. kentucky tax exemptions. Many states have special sales tax rates that apply. Is Kentucky Tax Exempt.